Ace quick missions & earn crypto rewards while gaining real-world Web3 skills. Participate Now ! 🔥

The best Solana DEX platforms are rapidly gaining attention thanks to Solana’s capability for fast, low-cost transactions. As more developers and crypto enthusiasts flock to this blockchain, it’s no surprise that the best Solana DEX projects are drawing investors intrigued by high throughput and innovative features.

If you’re looking to safeguard your Solana or expand your options, consider using a hardware wallet like Ledger or Trezor to keep your assets secure, especially as these DEXs continue to grow in popularity.

That said, let's explore the best and most popular Solana decentralized exchanges:

- Jupiter – A User-Friendly Solana DEX With a Vast Liquidity Pool

- Drift Protocol – An Innovative Solana DEX for Spot and Perpetual Trading

- Bitexen - Turkey-Focused Crypto Exchange

- Kamino Finance – A Solana DEX With Optimized Liquidity Management

- Raydium – An Efficient Solana DEX for High-Performance Trading

- Orca – A Solana DEX With a Highly-Intuitive User Experience

- Saros Finance – An Innovative Solana DEX With Comprehensive Tools

- Meteora – A Highly Liquid Solana DEX for Various Tokens and Memecoins

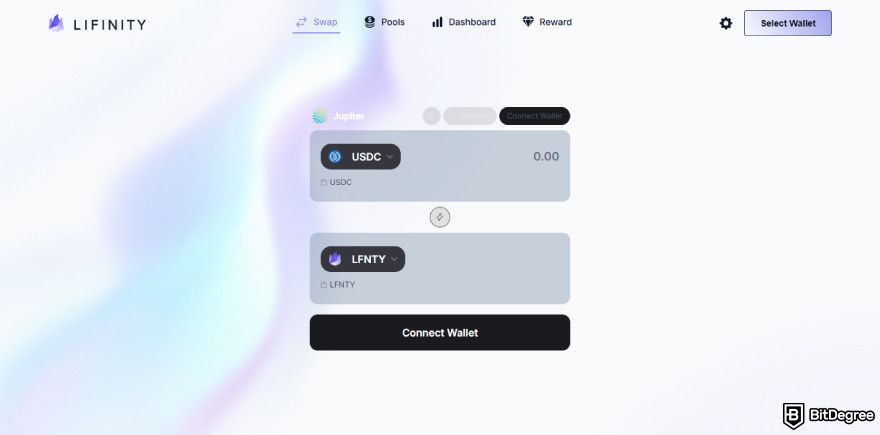

- Lifinity – A Proactive Market Marker Within the Solana DEX Ecosystem

- Zeta Markets – A Fast Solana DEX for Derivatives and Futures Trading

Let's begin the evaluation!

First Off: What is a DEX for Solana?

A DEX (Decentralized Exchange) for Solana is a cryptocurrency exchange that operates on the Solana blockchain, allowing users to trade digital assets in a decentralized manner.

Unlike centralized exchanges (CEXs), DEXs do not rely on a central authority or intermediary to facilitate transactions.[1] Instead, they operate through smart contracts, which are self-executing contracts with the terms directly written into code.

The main difference between a DEX and a CEX lies in their underlying structure. A single entity controls centralized exchanges, and users must trust that company to manage their funds and execute trades accurately.

In contrast, a DEX is decentralized, meaning users maintain full control over their funds throughout the trading process. These platforms allow users to trade directly from their wallets using liquidity pools, which are decentralized pools of assets provided by users.

📚 Read More: DEX VS CEX

Since users retain control of their private keys and assets, DEXs offer enhanced privacy and security compared to CEXs. Additionally, they're not subject to the same regulatory constraints as centralized platforms, providing more freedom for trading a wider variety of tokens.

Another key difference is fees. While CEXs typically charge higher fees to cover operating costs and profit margins, DEXs on Solana offer significantly lower transaction rates due to the network’s scalability and efficiency.

Moreover, the transparency of DeFi platforms, enabled by the blockchain, means all trades and liquidity movements are public and verifiable.

In summary, while both DEXs and CEXs serve the same fundamental purpose—allowing users to trade cryptocurrencies—the key differences lie in control, security, fees, and decentralization. Solana DEXs offer a faster, cheaper, and more secure alternative for users who prefer to retain control over their assets.

1. Jupiter – A User-Friendly Solana DEX With a Vast Liquidity Pool

Ranks #1 out of 10 Crypto Exchanges

- + Fast transaction speed

- + Low transaction fees

- + Biometric authentication for mobile app

- + Vast network of liquidity pools

- + Smart contracts regularly audited

- - Regional restrictions

Jupiter is a prominent DEX aggregator on Solana, offering a fast and efficient way to swap tokens. By utilizing the network's high throughput and low transaction fees, Jupiter ensures that users can execute near-instant trades with minimal costs.

One of its standout features is the user-friendly interface, which makes it accessible to both novice and experienced traders.

The platform also integrates seamlessly with Solana wallets, enabling easy access to funds, especially since these storage solutions have one-click interactions using links or QR codes as a feature.

Based on my observation, all the best Solana DEXs have one thing in common: security is the key priority, and Jupiter is no exception. Recently, the DEX implemented fingerprint biometric authentication on its mobile app, ensuring that not just anybody can access a user’s wallet and recovery phrase.

Like with most decentralized infrastructures, Jupiter utilizes smart contracts to automate its operations. There are no centralized middlemen, ensuring users retain full control over their assets.

But not to worry, reputable blockchain security firms like Sec3 regularly audit Jupiter’s smart contracts, checking for potential exploits.

When it comes to liquidity, Jupiter provides a vast network of supported DEXs and liquidity pools. The aggregator feature enables users to execute large trades without significant slippage. How is that possible?

Unlike traditional DEXs, which require manually searching for optimal trading pools, Jupiter automatically selects the best liquidity paths using advanced algorithms. Traders can customize parameters like transaction fees and slippage to further optimize transactions.

Moreover, the platform's backend system continuously analyzes market data, such as price and depth, to route transactions through the most cost-effective paths, even considering indirect token swaps. This ensures a seamless, user-friendly experience, with all complex calculations handled automatically for optimal results.

However, Jupiter is restricted in several jurisdictions, including the US, Singapore, the Republic of China, and Myanmar, due to regulatory concerns surrounding DeFi.

Nevertheless, Jupiter is still one of the best DEXs for Solana traders who want the most efficient way to exchange tokens on the blockchain. Its seamless, fast, and cost-effective service with significant liquidity makes it a top choice in the Web3 universe.

2. Drift Protocol – An Innovative Solana DEX for Spot and Perpetual Trading

Ranks #2 out of 10 Crypto Exchanges

- + Spot and perpetual trading

- + Robust liquidity

- + Just-in-Time auction mechanisms

- + Backstop Automated Market Maker

- + Up to 11.45% APR in staking rewards

- - High learning curves

- - Highly dependent on Solana network

Drift Protocol is an innovative platform on the Solana blockchain, recognized for its advanced trading features and efficient design. It’s one of the best Solana DEXs, providing users with access to spot trading, perpetual futures, and robust liquidity mechanisms.

Many of its features stand out. Mechanisms like Just-in-Time (JIT) auctions and Backstop Automated Market Maker (AMM) enhance capital efficiency and reduce slippage. Meanwhile, Market Maker Vaults ensure liquidity while providing opportunities to earn fees passively.

Furthermore, advanced options such as leveraged trading, perpetual swaps, and automated bots empower traders to execute sophisticated strategies. For those holding Solana tokens, the “Super Stake SOL” system offers unique rewards of up to 10.45% APR on staked funds, further integrating Drift with the Solana ecosystem.

However, the protocol's advanced features may present a learning curve for newcomers, making it more suitable for experienced traders. Additionally, its reliance on Solana as a single blockchain poses potential risks if the network experiences disruptions.

Regardless, if you're wondering where to trade Solana tokens, Drift Protocol is a top contender. With its blend of cutting-edge technology and user-centric design, it offers a compelling option for those seeking efficient, high-speed trading.

3. Bitexen - Turkey-Focused Crypto Exchange

Ranks #3 out of 10 Crypto Exchanges

- + Instant Buy/Sell functionality

- + Multiple cryptocurrencies support

- + Bitexen Research section for market analysis

- + Security audited by reputable firm

- + Internal Transfer for immediate, cost-fee transactions

- - Fiat transactions are restricted to Turkish lira

- - Customer support available in limited languages

Bitexen is a centralized cryptocurrency exchange based in Turkey, founded in 2018. The platform enables users to buy, sell, and trade a broad range of cryptocurrencies, offering over 300 digital assets, including Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and numerous altcoins. While Bitexen aims to serve a global audience, it has established a strong foothold in Turkey, positioning itself as a reliable platform for local users.

Bitexen is accessible via both web and mobile platforms, offering an intuitive interface that caters to a wide spectrum of traders. The platform provides several trading features, such as spot trading, derivatives, and instant trades, making it suitable for both beginner and advanced traders who wish to explore various trading strategies. This versatility enables users to engage in different forms of crypto trading depending on their preferences and expertise.

The exchange supports fiat on-off ramps for the Turkish Lira (TRY), enabling seamless deposits and withdrawals for Turkish traders. This feature makes Bitexen a convenient option for users in Turkey looking to move funds between their bank accounts and crypto holdings.

Bitexen also offers a global version that caters to a wider range of users.

For security, Bitexen employs a comprehensive approach, including a strict Know Your Customer (KYC) verification process to ensure the identity of its users. The platform also integrates two-factor authentication (2FA) to add an extra layer of protection for user accounts.

To further strengthen security, Bitexen runs a bug bounty program that incentivizes security researchers to responsibly report vulnerabilities, ensuring the platform's security remains robust and resilient against potential threats.

With its variety of cryptocurrencies, user-friendly interface, fiat compatibility, and strong security measures, Bitexen provides a solid platform for cryptocurrency trading, particularly for Turkish users.

Did you know?

All Crypto Exchanges may look similar to you but they're NOT all the same!

4. Kamino Finance – A Solana DEX With Optimized Liquidity Management

Ranks #4 out of 10 Crypto Exchanges.png)

- + Optimized for yield farming

- + Deep liquidity and tight spreads

- + Cost-effective

- - Possible issues using Creator Vaults

- - Restricted in the US, UK, and OFAC-sanctioned countries

Kamino Finance is a Solana DEX that focuses on liquidity management and maximizing returns for liquidity providers. It simplifies yield farming by letting users deposit tokens into liquidity pools while automatically optimizing returns through smart vault technology.

One of the key features is automated liquidity management, which uses quantitative models to adjust positions automatically. This reduces the need for manual oversight, saving users time while maximizing earnings.

Plus, its capital efficiency enables users to earn higher fees with less capital by utilizing concentrated liquidity pools, making it a cost-effective choice for market makers.

Kamino’s native KMNO tokens add to the platform's flexibility, seamlessly integrating into other DeFi applications like lending and borrowing protocols. This allows users to expand their strategies across multiple platforms.

In addition, the platform features an easy-to-use interface, making it accessible for both experienced market makers and beginners.

📚 Read More: Best Lending Platforms

Kamino also integrates with leading Solana DEXs like Raydium, ensuring deep liquidity and minimal slippage. Leveraging Solana’s high-speed and low-cost blockchain, the DEX keeps transaction fees low, making frequent trading more affordable compared to Ethereum-based platforms.

With its sleek and intuitive interface, Kamino Finance makes it easy to track investments, yield, and portfolio performance. It also includes risk management tools like customizable exposure levels to help protect assets.

Moreover, Kamino’s Creator Vaults provide advanced tools for experienced market makers to manage liquidity positions with greater flexibility. Users can tailor their strategies to specific market conditions, offering a high degree of customization.

However, since Creator Vaults is a relatively new feature, it may still have some issues.

Users from the US, UK, and OFAC-sanctioned countries are restricted from trading on Kamino Finance.

Overall, Kamino Finance is one of the best Solana DEX platforms for liquidity providers, offering automated yield optimization, deep liquidity, and an easy-to-use experience.

5. Raydium – An Efficient Solana DEX for High-Performance Trading

Ranks #5 out of 10 Crypto Exchanges

- + High performance with Solana

- + Unique hybrid AMM design

- + Low transaction fees

- + Extensive educational resources

- + Earning features

- - Past security concerns

- - Limited accessibility in some countries

Raydium is widely regarded as one of the best Solana DEX platforms, offering high-performance trading. Thanks to Solana’s ability to process up to 65,000 transactions per second with fees as low as $0.01, the platform provides traders with a seamless and cost-effective experience.

What sets it apart is its unique hybrid AMM model. Unlike traditional decentralized exchanges, Raydium integrates an Automated Market Maker (AMM) with OpenBook’s central limit order book, allowing traders to access deeper liquidity and better pricing.

Moreover, the Best Price Swaps feature ensures users receive the most optimal trade execution by automatically routing orders through liquidity pools or the order book, making trading more efficient and effective.

Beyond that, Raydium offers multiple earning opportunities. Users can participate in liquidity provision through its Concentrated Liquidity Market Maker (CLMM) system, earning fees based on liquidity provision in specific price ranges.

Additionally, staking RAY tokens empowers users to generate passive income over time, making the DEX attractive for DeFi enthusiasts looking to maximize their earnings.

Thanks to Solana’s low-cost infrastructure, Raydium keeps fees minimal, making frequent trading and DeFi participation more accessible compared to Ethereum-based DEXs that suffer from high gas fees.

However, in December 2022, the platform experienced a security breach that resulted in a $4+ million loss due to a private key compromise.

While the team took swift action to enhance security, the incident serves as a reminder of the inherent risks associated with DeFi platforms.

Raydium is unavailable in certain regions, including the US, Iran, and North Korea.

For traders and DeFi enthusiasts looking for the best Solana DEX, nevertheless, Raydium remains a top-tier option. Its speed, innovative AMM model, and multiple earning opportunities make it a top choice. However, users should remain cautious about security risks and regional restrictions before diving in.

6. Orca – A Solana DEX With a Highly-Intuitive User Experience

Ranks #6 out of 10 Crypto Exchanges

- + Fast and cheap swap transactions

- + Concentrated liquidity pools

- + User-friendly UI

- + Environmental and educational initiatives

- - Increased risk of divergence loss

- - Low number of cryptocurrencies on V1

Orca is another strong contender, providing a highly intuitive user experience while leveraging Solana’s speed and low costs.

Unlike traditional order book exchanges, Orca operates as an AMM, allowing users to trade Solana tokens without intermediaries. Its features, such as the Fair Price Indicator, Magic Bar, and Portfolio Tracker, make trading easier for both beginners and advanced users.

The platform also offers liquidity mining and staking opportunities, allowing users to earn more rewards by providing liquidity to the crypto pool or participating in governance.

Meanwhile, concentrated liquidity pools help improve capital efficiency, reducing slippage and making large trades more cost-effective. These advantages make Orca an appealing choice for those curious about where to trade Solana tokens efficiently.

However, in March 2023, the platform restricted US users due to regulatory concerns.

7. Saros Finance – An Innovative Solana DEX With Comprehensive Tools

Ranks #7 out of 10 Crypto Exchanges

- + Comprehensive DeFi products

- + Smart Order Routing

- + Supports Limit Orders

- + Optimized Smart Contracts

- - Potential limited liquidity

- - High learning curve for new users

Saros Finance is a Solana DEX designed to offer a seamless and efficient trading experience.

It combines multiple DeFi products, including SarosSwap (AMM), SarosFarm (liquidity pools), and SarosStake (staking), creating a comprehensive ecosystem for traders, liquidity providers, and stakers.

The platform is gaining popularity as one of the best DEXs for Solana, providing a user-friendly interface that appeals to both new and experienced traders.

At the core of this DEX is SarosSwap, an AMM that allows users to trade tokens directly from their wallets without intermediaries. One of its standout features is smart order routing, helping users get the best possible price.

Additionally, Saros Finance supports limit orders, a rare feature among DEXs, enabling users to set desired trade prices rather than executing swaps at the current market rate. This adds a layer of control and flexibility, making Saros Finance one of the best Solana swap exchanges.

For liquidity providers, SarosFarm offers the opportunity to earn rewards by supplying liquidity to various pools. Users receive LP tokens representing their share of the pool, allowing them to benefit from transaction fees.

That way, the platform ensures liquidity providers are adequately incentivized, contributing to its overall efficiency and appeal. SarosStake further enhances the ecosystem by enabling users to stake tokens for additional rewards, encouraging long-term participation and supporting the DEX's stability.

Subsequently, the launch of Saros Finance V2 introduced several enhancements, such as optimized smart contracts for improved efficiency, an upgraded interface for better navigation, and expanded token support.

Despite its advantages, as a relatively new platform, Saros Finance faces the challenge of building sufficient liquidity to compete with more established Solana DEXs.

Additionally, while its advanced features like smart order routing and limit orders are beneficial, they may have a learning curve for new users.

8. Meteora – A Highly Liquid Solana DEX for Various Tokens and Memecoins

Ranks #8 out of 10 Crypto Exchanges

- + Competitive fees for liquidity providers

- + Vast selections of memecoins

- + Integration with Jupiter for best trading rates

- + Dynamic liquidity for various tokens and memecoins

- - Some potential liquidity risks

- - Potential issues due to being a new platform

Meteora aims to establish a secure, sustainable, and composable liquidity layer for DeFi users. By leveraging Solana's speed and scalability, it offers innovative solutions to enhance trading efficiency.

At the core of Meteora's offerings is the Dynamic Liquidity Market Maker (DLMM), which provides liquidity providers (LPs) with dynamic fees and precise liquidity concentration in real-time.

This system organizes liquidity into discrete price bins, allowing swaps to occur without slippage. Consequently, LPs benefit from dynamic fees during periods of market volatility, compensating for potential impermanent loss.

Meteora also introduces Dynamic AMM Pools, enabling LPs to earn additional yield by utilizing lending sources alongside traditional swap fees. Such an approach enhances returns and capital efficiency, making it an attractive option for those looking to maximize their assets on a Solana decentralized exchange.

For traders seeking efficient token swaps, the platform integrates with Jupiter to ensure the best rates available. This integration simplifies the process of acquiring the necessary tokens for liquidity provision, enhancing the overall user experience.

Recognizing the growing interest in memecoins, the DEX has launched Dynamic Memecoin Pools to support their liquidity. These pools feature:

- Permanently locked liquidity to boost traders' confidence;

- Dynamic fees adjusted by the protocol to optimize for varying market conditions;

- Tracking by data analytics platforms to improve discoverability.

However, be aware of certain risks associated with providing liquidity on the platform. Depositing into an imbalanced pool or a pool with a price out of sync with the broader market can lead to losses due to arbitrage. It's crucial for LPs to compare pool prices with other markets and utilize features like the [Sync with Jupiter's price] button to mitigate this risk.

In summary, Meteora stands out as a dynamic and sustainable liquidity layer on Solana, offering innovative tools and integrations that cater to both liquidity providers and traders. Its focus on enhanced yield opportunities and support for emerging assets positions it as a compelling choice for those engaged in the Solana DeFi ecosystem.

📚 Read More: Best Solana Memecoins

9. Lifinity – A Proactive Market Marker Within the Solana DEX Ecosystem

Ranks #9 out of 10 Crypto Exchanges

- + Proactive market making

- + Efficient liquidity provision

- + Innovative AMM model

- + Fast and cost-efficient

- - Impermanent loss risk

Lifinity is recognized as the first proactive market maker designed to enhance capital efficiency and mitigate impermanent loss within a DEX ecosystem on the Solana blockchain.

Unlike traditional DeFi platforms that utilize constant product or hybrid AMM (AMM) models, Lifinity employs a unique approach by concentrating liquidity within specific price ranges.

This strategy involves applying leverage to the constant product formula, effectively increasing liquidity depth where it's most needed, which improves capital efficiency and reduces slippage.

Additionally, the DEX integrates Oracle-based pricing mechanisms, using external data sources to set and adjust prices. Such a proactive strategy aims to reduce reliance on arbitrageurs and minimize impermanent loss by ensuring that prices closely reflect the broader market.

However, potential users should be aware of certain considerations. The reliance on external Oracles for pricing introduces dependencies that could pose risks if the data is inaccurate or delayed.

Additionally, while the concentrated liquidity model enhances capital efficiency, it may require LPs to have a deeper understanding of market dynamics to manage their positions effectively.

Furthermore, as with many decentralized exchanges, Lifinity may face challenges related to liquidity depth, particularly in less popular trading pairs, which can lead to higher slippage for larger transactions.

In summary, Lifinity offers an innovative approach to decentralized trading on the Solana blockchain, focusing on proactive market-making and capital efficiency. While it presents several advantages over traditional AMMs, users should carefully consider the complexities and potential risks associated with its unique model.

10. Zeta Markets – A Fast Solana DEX for Derivatives and Futures Trading

Ranks #10 out of 10 Crypto Exchanges

- + Derivatives, options, and futures trading

- + Low latency trading with high throughput

- + Multiple liquidity pools

- + Cost-efficient

- - Issues with network congestion and outages

Zeta Markets is a DEX built on the Solana blockchain, designed to facilitate fast, efficient, and secure trading. It aims to bring traditional financial products like options and futures to the decentralized ecosystem, offering the ability to trade complex instruments with minimal slippage and low fees.

One of the standout features is its synthetic options trading capabilities. Unlike many traditional DEXs, which focus primarily on spot trading, Zeta enables users to trade a range of derivatives on the Solana blockchain.

Zeta’s platform also boasts low-latency trading with high throughput, leveraging Solana’s speed and scalability to process a large volume of transactions quickly and cost-effectively.

However, some users have reported issues with order reliability, such as missed or unreliable take-profit and stop-loss orders, which can undermine trading strategies. The process of signing transactions has also been described as cumbersome.

Regardless, the platform is still a popular choice. The protocol offers a secure, non-custodial way to trade without the need for an intermediary.

Furthermore, Zeta helps mitigate risks associated with centralized exchanges, such as counterparty risk. As a result, users have more control over their assets. The DEX also features a user-friendly interface, making it easy for traders of all experience levels to navigate and execute trades efficiently.

In terms of liquidity, Zeta Markets is integrated with Solana’s high-performance ecosystem, offering fast order execution and reduced slippage. Its liquidity pools are supported by a combination of LPs and market makers, ensuring that orders can be executed without significant delays or price differences.

In terms of liquidity, Zeta Markets is integrated with Solana’s high-performance ecosystem, offering fast order execution and reduced slippage. Its liquidity pools are supported by a combination of LPs and market makers, ensuring that orders can be executed without significant delays or price differences.

Overall, Zeta Markets offers an exciting and innovative solution in the Solana DEX space, particularly for users interested in trading more advanced financial instruments like options and futures. Its low fees, fast transactions, and robust protocol make it a strong contender in the Solana-based decentralized exchange landscape.

Best Solana DEX: Evaluation Criteria

To ensure transparency, I will first share my criteria for ranking the best Solana DEXs as a reference for your research. Several key factors are essential to ensure a smooth, secure, and efficient trading experience.

The first and most important factor is liquidity. A decentralized platform with high liquidity ensures that traders can execute orders quickly and at fair prices without significant slippage. Liquidity pools benefit from the blockchain’s fast transaction speeds and low costs,[2] making them more attractive to users.

Transaction speed is another crucial aspect. Solana’s blockchain is known for its remarkable speed, processing thousands of transactions per second.

A top-tier DeFi platform will leverage this capability, offering users near-instant trade confirmations and a smooth trading experience, especially during periods of high market volatility.

Additionally, the best Solana DEXs implement advanced security measures, such as smart contract audits, multi-signature wallets, and robust encryption protocols, to ensure users’ funds and data remain protected from potential hacks or vulnerabilities.

User interface (UI) and experience (UX) are also critical for attracting and retaining users. Any platform should offer an intuitive, user-friendly interface that simplifies the trading process for beginners and experienced traders.

Features like customizable dashboards, easy navigation, and support for multiple trading pairs are essential for providing a seamless experience.

Fees are another important consideration. The best Solana DEXs should have low trading fees, allowing users to trade efficiently without incurring excessive costs.

Finally, community support and active development are important, as they contribute to the DEX's long-term growth and ability to adapt to market changes.

A combination of liquidity, speed, security, user experience, and low fees should guide your decision when selecting the best Solana DEX for your needs.

Conclusions

Closing the curtains, the best Solana DEXs provide fast, secure, and cost-effective trading experiences, taking full advantage of the blockchain's speed and scalability. As for which is the best for you, it ultimately depends on the specific set of features you are looking for.

Platforms like Jupiter, Orca, and Raydium are shaping the decentralized trading landscape, offering advantages such as liquidity pools, lower fees, and improved user interfaces.

Whether you prioritize advanced features like derivatives trading or a user-friendly platform, Solana DEXs cater to diverse needs.

The content published on this website is not aimed to give any kind of financial, investment, trading, or any other form of advice. BitDegree.org does not endorse or suggest you to buy, sell or hold any kind of cryptocurrency. Before making financial investment decisions, do consult your financial advisor.

Scientific References

1. Li X., Wang X., Kong T., Zheng, J.: 'From Bitcoin to Solana – Innovating Blockchain Towards Enterprise Applications';

2. Hagele, S.: 'Centralized exchanges vs. decentralized exchanges in cryptocurrency markets: A systematic literature review'.